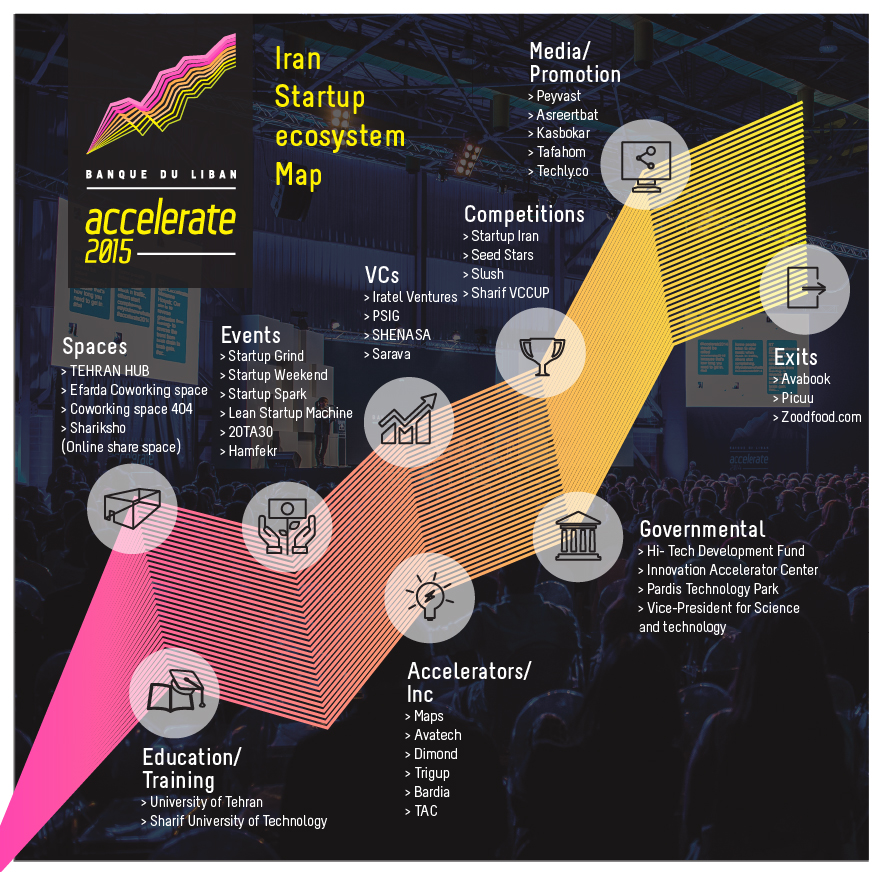

The Iranian Startup Ecosystem

Written by

Just days after the nuclear deal agreement in Vienna, European countries and companies filled up planes with their nations’ economic elite to head to Iran to get a move on gaining ground in one of the largest untouched emerging markets. The current population of Iran is around 80M, 53M of which are below the age of 35, and 55M are Internet users. Iran also has the highest number of educated individuals in the MENA region as well as the highest mobile penetration rate in the region at 120%.

During the decade long implementation of sanctions on Iran to cripple the $400 billion economy on multiple levels, Iranian startups have had to operate without access to foreign markets, finances, and social media channels. Many used this to their advantage by creating their localized versions of international startups and building startups according to local needs, including the Amazon-inspired marketplace Digikala — now valued at up to $500 million, the Groupon-like Takhfifan, leading Android app store Café Bazaar, audio and video streaming services Aparat (YouTube) and Navaak (Spotify), Esam (similar to Ebay), social network Cloob, and Hamijoo (Kickstarter).

Businesses were forced to collaborate and interact with other locals, since they were cut off from the rest of the world, empowering the startup ecosystem. The startup scene developed without any international competitors or the influence of massive external businesses; however, due to the sanctions, Iran’s startups were constrained since they were only capable of growing as big as Iran’s population, albeit that is not a small number.

In terms of human talent, considering the high percentage of university graduates and a high youth unemployment rate at 25%, there is a myriad of candidates for any open positions. It also is worth mentioning that there are noticeably more female entrepreneurs in Iran than in other ecosystems, which may be due to the fact that 70% of technology, science, and engineering students in Iran are women. However, although there are several well established and successful startups, none have been able to exit due to the sanctions, and as such, the ecosystem lacks role models and success stories.

The lifting of the sanctions will benefit the Iranian startup ecosystem by providing more opportunities and access to different markets, causing them to thrive and mature, as well as raise competition with both local and global players. Many of the seed stage and early stage companies dominant in their markets can raise foreign investments in order to expand.

Several events have been taking place outside the country to develop relationships and educate investors on the startup scene, as well as to build connections with its diaspora. For instance, in June, the iBridges conference gathered 2000 participants in Berlin, mostly Iranians living in the US, Europe and Iran as well as foreign investors and seasoned Silicon Valley entrepreneurs. The conference highlighted potential investment opportunities in the startup scene once the sanctions are lifted, explored the role that the startup ecosystem could play in Iran’s development, and the millions of jobs that could be created if the country moved towards a knowledge-based economy.

Although the startup ecosystem in Iran is behind other countries in the region, with a low competitive market and many untouched markets and segments, plus very low operation costs and salaries, it will be able to thrive and expand much faster than its regional counterparts. It is not hard to believe that Iran could become the startup hub of the region considering all the interest, especially from investors to invest in it. With a rapidly growing ecosystem and the lifting of the sanctions, more and more international startup professionals are flying to Iran to collaborate and connect with the potentials the country has to offer.

According to a study by Migreat, the majority of entrepreneurial migrants to the US are going from the region. It really is no surprise; the region has a long history of entrepreneurship since it is where international trade started a long time ago, and seems to be an innate trait of the culture. By developing solid ecosystems, entrepreneurs would be encouraged to remain in the region. Under the theme ‘Emerging Startup Ecosystems,” BDL Accelerate 2015 aims to discuss the challenges and best practices of emerging ecosystems, including Iran, to exchange knowledge and explore opportunities the ecosystems can collaborate to create a competitive region and mature their ecosystems.

To register to attend click here.